Microsoft Worldwide Utility Study Reveals Status of Smart Grid Adoption

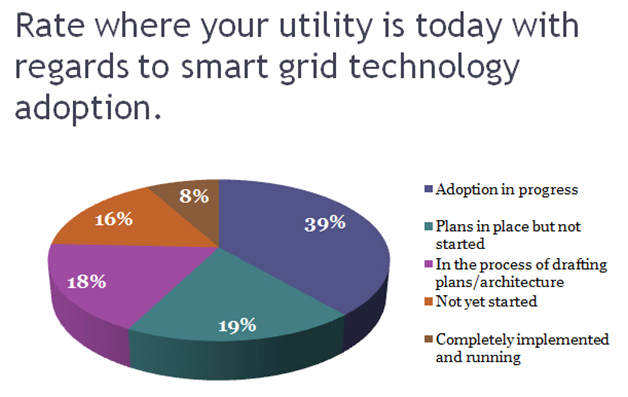

Investment in smart grid technology clearly is evolving among power and utility companies around the world.

According to the second Microsoft Worldwide Utility Survey, announced today at CERAWeek 2011 in Houston, the study revealed that utility companies face a number of challenges when striving to move from planning to actual smart grid implementation. They include the following:

- Financial - 27%

- Organizational - 15%

- Lack of a comprehensive plan - 15%

- Regulatory - 14%

- Technical - 12%

- Operational - 10%

Additionally, 64% said they don't have a clear view of the enterprise-wide information and technology infrastructure they will use to structure current and future smart grid deployments.

Jon Arnold, managing director for Microsoft's Worldwide Power & Utilities Industry, notes that more progress is occurring at the foundational level.

"We're seeing much more occurring in the way of planning and adapting architectures," he said. "Our discussions with clients about Microsoft's Smart Energy Reference Architecture (SERA), a smart grid guidance document, indicate utilities require additional planning and a new architectural approach to address their smart grid technology challenges and transform their existing business operations."

A core strength of SERA is ensuring that future smart grid technology advances will integrate with and protect today's investments. Among respondents to the survey, 64 percent said the flexibility to adapt to new and future technologies is paramount to achieving the grid of the future.

Despite these challenges, survey respondents are optimistic that the capabilities of today's power systems and IT support can address tomorrow's challenges (70%) - a notable increase from last year's response (43%). A similar number (73%) expect budgets to support smart grid efforts to rise.

"We're seeing a normal phenomenon occur in terms of the evolution of the thinking about these projects," said Arnold. "Utilities are finding out what they don't know, and they are naturally exerting some caution before making big investments, even though the willingness to spend is there."

The Microsoft Worldwide Utility Survey polled 215 professionals within electric, gas and water utilities and related companies around the world.