Distinguishing between concepts in Microsoft Dynamics AX 2012: stock vs. inventory

In this blog entry we take a closer look at how we apply the concepts named stock and inventory in Microsoft Dynamics AX 2012.

But before we examine the concepts named stock and inventory, I offer some background on and a clarification of the term item, which is also applied in unique contexts with respect to the concepts named stock and inventory.

Item

We use the term item as a stand-alone termto name a tangible or intangible object. An item is an element of an itemized list, such as a line item, budget item, stock item, or inventory item.

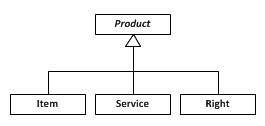

The following conceptual object model illustrates the term product item. It elaborates the concept named product and the types of products—product item, product service, and product right. The concept named product right was not implemented in Microsoft Dynamics AX 2012.

Microsoft Dynamics AX 2009 does not have a Product information management module, and the term item is used as a stand-aloneterm in the context of inventory control. A Product information management module was developed for Microsoft Dynamics AX 2012 to maintain data representing products of type item and service. We now distinguish between a product item, a type of product, and an inventory item that is registered as inventory. Although we do use the term item as a stand-alone term when the context is clear, we do not use the term item to mean product item.

Stock, stock item, and stocked

We use the term stock to name a classification of product items that are owned and controlled by organizations. The Microsoft Dynamics AX product is used to document stock flow events, that is, the occurrences of actions that register the inflow and outflow of stock from storage locations. Stock balances are calculated by summing stock flows in and out of storage locations over a given time period.

(Note that in the Microsoft Dynamics AX product, the concept named storage location is named inventory location in the code and warehouse on the user interface.)

In Microsoft Dynamics AX, the term stock is not a synonym for the term inventory because it is necessary for an organization to track quantities of stock that are not used or consumed by product delivery activities, for example, fixed assets, such as chairs and tables.

We use the term stock item to represent an itemized product item that participates in a stock tracking process.

We use the term stocked to represent a policy that controls whether product items are tracked in stock.

The concept named stock was introduced in Microsoft Dynamics AX 2012 so that public sector customers could track product item stock receipts and issues without recording the financial consequences of these stock flow events in inventory accounts. This concept is also necessary for vendor-managed inventory and consignment scenarios in which the organization that controls or possesses stocked items is not the same organization that owns the stocked items.

The concept named stock item has been realized in Microsoft Dynamics AX 2012 by providing an option to set up an inventory item as a stocked product by using an inventory policy.

Inventory and inventory item

We use the term inventory to classify products that an owning organization uses in its product delivery activities and whose value is calculated by using an inventory valuation method and is recorded in inventory accounts.

Microsoft Dynamics AX supports the accounting principle that requires organizations to match expenses to revenue. Merchandising and manufacturing organizations that purchase product for sale or for use in manufacturing activities need to classify costs that are allocated to products as inventory until the products are sold and the cost of goods sold are expensed. Not all stock is inventory, but all inventory product items are stock when inventory is defined in this manner.

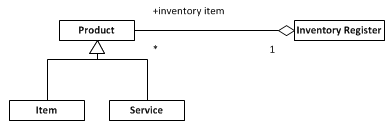

Fixed assets could also be a subset of stock, and the value of fixed assets is depreciated over multiple accounting periods.

In Microsoft Dynamics AX 2009, products are set up as inventory items in the Inventory management module. Products of type item and products of type service assume the role of inventory items so that they can be referenced in product structures, such as bills of material (BOMs) and product configurations, and so that they can be referenced when they participate in operating activities (purchase, sales, production, and so on). In Microsoft Dynamics AX 2012, product item and service data is maintained by using the Product information management module. It is still, however, necessary for products of type item and products of type service to assume the role of inventory items and to be set up by using the Inventory management module so that they can be referenced and identified.

A release action is required to release products from the Product information management module for registration as inventory items. A second step is required to set up an inventory item as a stocked item, as an inventory item whose value is classified by using inventory or expense accounts, or as an inventory item that participates as a service in operating activities.

Term challenge

In the sentences that follow, insert the term that accurately completes each sentence.

To see if you applied the terms as we have, click the link in each sentence. Each link will take you to the Microsoft Dynamics AX glossary entry for the highlighted term, which shows you which term we have applied – stock or inventory.

- The portion of ____________ that is not allocated and which can be used to fulfill new orders and requirements is named available to promise (ATP).

- An inventory registration policy is a policy that controls when ____________ that is stored in a supermarket is registered as ____________.

- An expense product is a received product that is a current asset, not held for sale or consumed in production, and for which there is no ____________ control policy requiring quantity tracking or ____________ control policy requiring stock value tracking, and for which there is an accounting policy requiring the recording of the cost as an expense.