Dutch Tax BAPI Support Changing to KPN Certificates (2012)

INTRODUCTION

Electronic communication with the Dutch Tax administration is based on trusted connections using Digital Certificates. In 2011 an incident has occurred with Diginotar, one on the Certificate Authorities (CA), resulting in a situation that an infiltrator was able to create new certificates on his own for every random domain. This made the whole certificate-based environment unsecure and required facilities to make sure that trusted digital communication remains possible in the future.

The Dutch Tax administration evaluated the different existing communication channels and decided to phase out one of these channels: BAPI-PIN. It has also been decided to no longer use Diginotar certificates but to give KPN (Getronics) the role as the Certificate Service Provider (CSP) for the future.

SUBMITTING VAT AND ICP DECLARATIONS USING MICROSOFT DYNAMICS AX

You can choose to submit VAT and or ICP to the Dutch Tax Authority by manually filling in a web form (www.belastingdienst.nl). There is a limit however for the ICP declaration. The website allows a maximum of 99 lines to be entered manually. An ICP Declaration report can be printed from Microsoft Dynamics AX to use as a guideline.

Microsoft Dynamics AX supports the BAPI PIN channel electronic communication. It does not support the BAPI PKI method!

PIN is the public key method used within the Microsoft Dynamics AX community. For this method you only need the certificates from the Tax authorities and CSP. To get these you have to fill in the form ‘Electronic tax declaration parameters’ and click the button ‘Get certificates’. The certificates for the PIN method can be acquired at no cost.

TIMELINE

With respect to BAPI PIN the following timeline has been set by the Tax authorities (latest communication in Feb 2012):

BAPI PIN: will be phased out by 1-1-2013 for all process flows (VAT, ICP, etc)

MICROSOFT DYNAMICS AX AND BAPI PIN

In order to continue using BAPI PIN until 2013 you will need to change the certificate settings to KPN before July 2012.

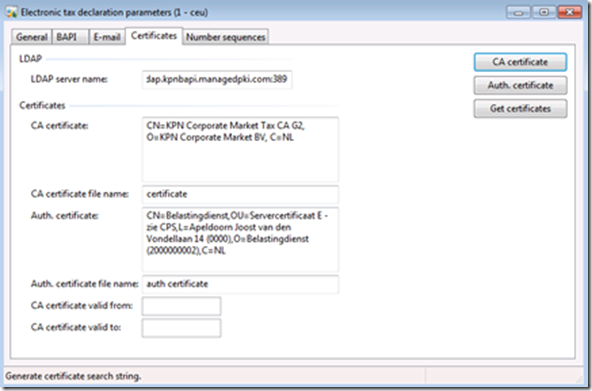

Change the following settings in General Ledger / Setup / Sales Tax / Netherlands / Electronic tax declaration parameters:

Make sure you have no ongoing declarations.

PRODUCTION environment

· LDAP server name:

ldap.kpnbapi.managedpki.com:389

· CA certificate search string:

CN=KPN Corporate Market Tax CA G2,O=KPN Corporate Market BV,C=NL

· Auth. certificate search string:

CN=Belastingdienst,OU=Servercertificaat E - zie CPS,L=Apeldoorn Joost van den Vondellaan 14 (0000),O=Belastingdienst (2000000002),C=NL

No need to change other settings. After that you can renew the certificate by using the button “Get Certificates” and do your normal submissions again.

TEST environment

· LDAP server name:

ldap.testkpnbapi.managedpki.com:389

· CA certificate search string:

CN=KPN Corporate Market Tax TEST CA G2,O=KPN Corporate Market BV,C=NL

· Auth. certificate search string:

CN=TEST Belastingdienst,OU=Servercertificaat E - zie CPS,L=Apeldoorn Joost van den Vondellaan 14 (0000),O=Belastingdienst (2000000002),C=NL